Author: Prathik Desai

Original Title: Gold, Bills, Thrills

Compiled and Edited by: BitpushNews

When I think of stablecoins, I often see them merely as a bridge between the US dollar and the blockchain, nothing more. They can be powerful infrastructure components, silently supporting the operation of on-chain products in ways that are often easily overlooked.

As a business model, stablecoin issuers have direct revenue, which is tied to the interest rates published by the US Federal Reserve. The higher the interest rates, the more income the US Treasury bonds backing their stablecoin circulation bring to the issuers.

However, in recent years, the world's largest stablecoin issuer by circulation has adjusted its reserve strategy to better adapt to the macroeconomic environment.

In this quantitative analysis, I will explore why and how Tether (Tether) is partially replacing its massive interest-earning engine with gold and Bitcoin to cope with the upcoming shift in the interest rate cycle.

Let's begin.

The US Treasury Machine

A glance at Tether's US Treasury reserves reveals how it became a profit machine during periods of high interest rates.

Over the past few years, USDT holders earned 0%, while Tether earned about 5% on approximately $1 trillion in US Treasury bonds.

Even with average interest rates relatively low for most of 2025, around 4.25%, as of September 30, 2025, Tether reported a net profit of over $10 billion for the year. In contrast, the second-largest stablecoin issuer, Circle, reported a net loss of $202 million for the same period.

For most of the past three years, Tether's business model perfectly aligned with the macroeconomic backdrop. The Federal Reserve maintained interest rates between 4.5% and 5.5%, and Tether held over $1 trillion in US bonds, with each percentage point of yield bringing in approximately $1 billion in annual revenue.

While most cryptocurrency companies struggled with operational losses, Tether accumulated tens of billions in surplus simply by going long on short-term government debt.

But what happens when the interest rate cycle turns, and rate cuts are expected in the coming years?

The Interest Rate Cycle Problem

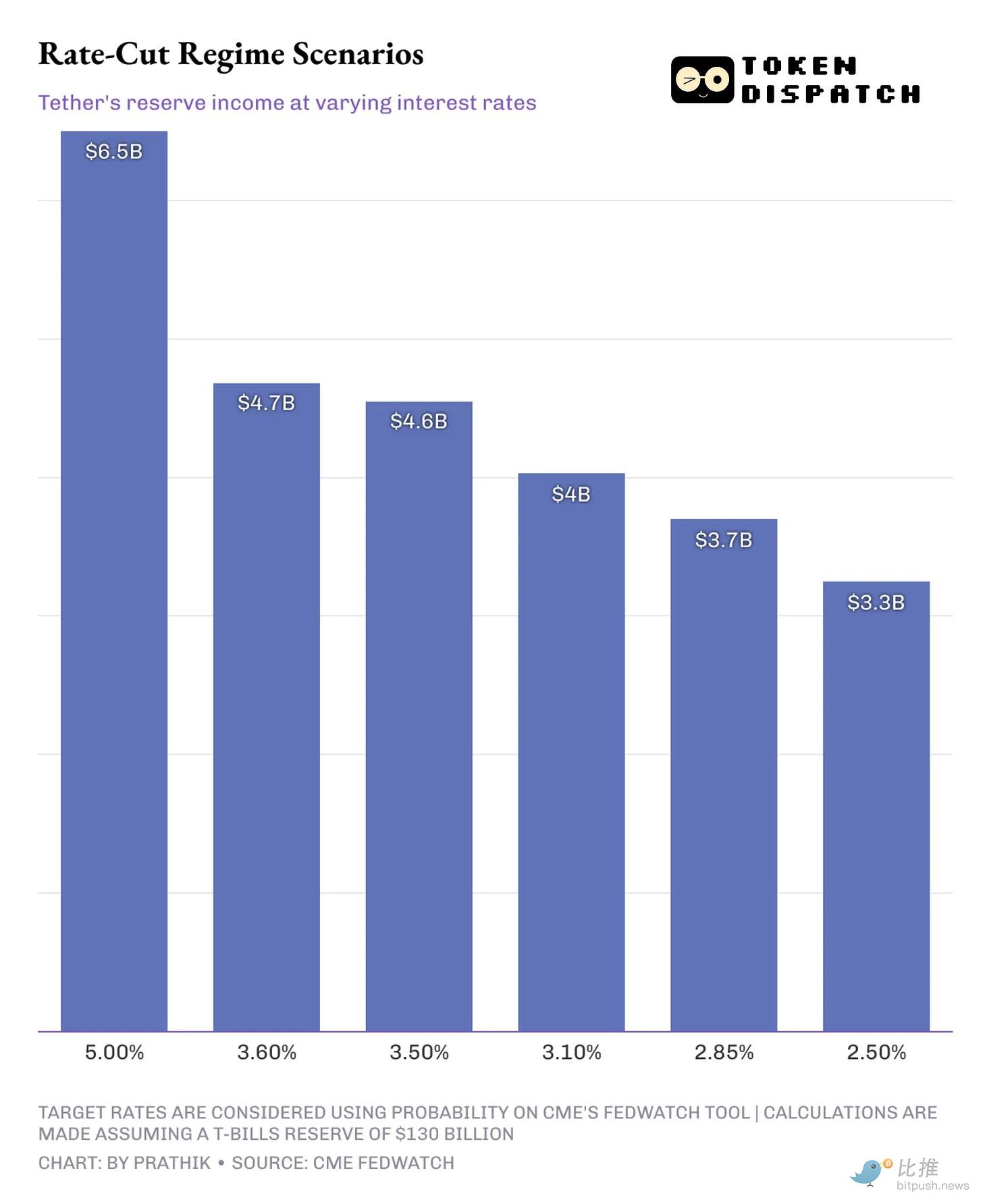

CME FedWatch data shows that by December 2026, there is over a 75% probability that the federal funds rate will drop from the current 3.75-4% range to between 2.75-3% and 3.25-3.50%. This is already a significant drop from the 5% level that Tether relied on for profits in 2024.

Lower interest rates could compress the interest income Tether earns from its US Treasury holdings.

A one-percentage-point drop in overall US economic liquidity could reduce Tether's annual income by at least $15 billion. This exceeds 10% of its annualized net profit for 2025.

So, how will Tether protect its profitability in this world? After Jerome Powell's term ends in 2026, a new Fed Chair is more likely to follow the expectations of US President Donald Trump for more significant and faster rate cuts.

It is at this point that Tether's reserve strategy diverges most significantly from any other stablecoin issuer.

Diversification Strategy

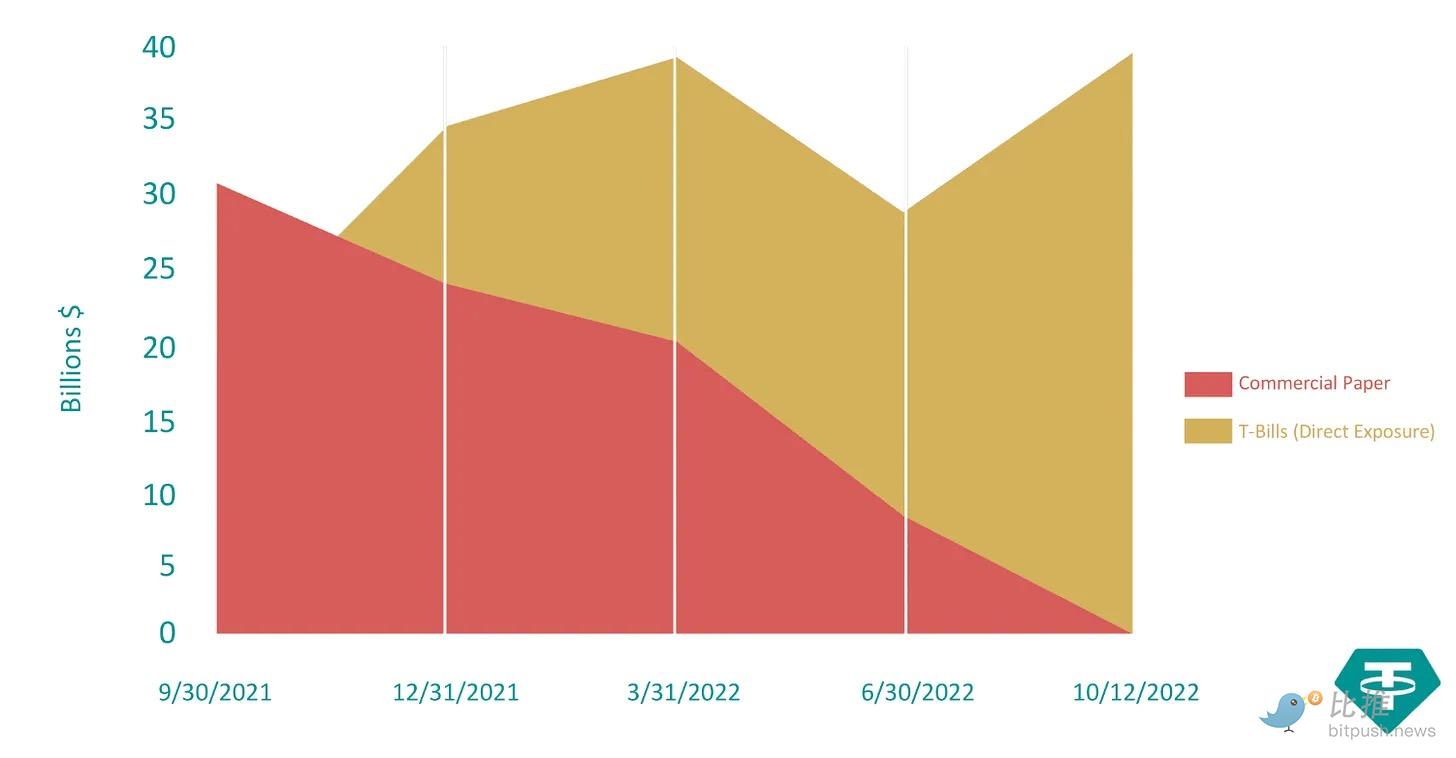

Between September 2021 and October 2022, Tether reduced its reliance on commercial paper (unsecured short-term debt instruments issued by large corporations) by over 99%. From over $30 billion in September 2021, it was cut to almost zero.

It replaced these assets with US-backed Treasury bonds to increase transparency for investors.

During the same period, Tether's US Treasury reserves grew from less than $25 billion to $40 billion.

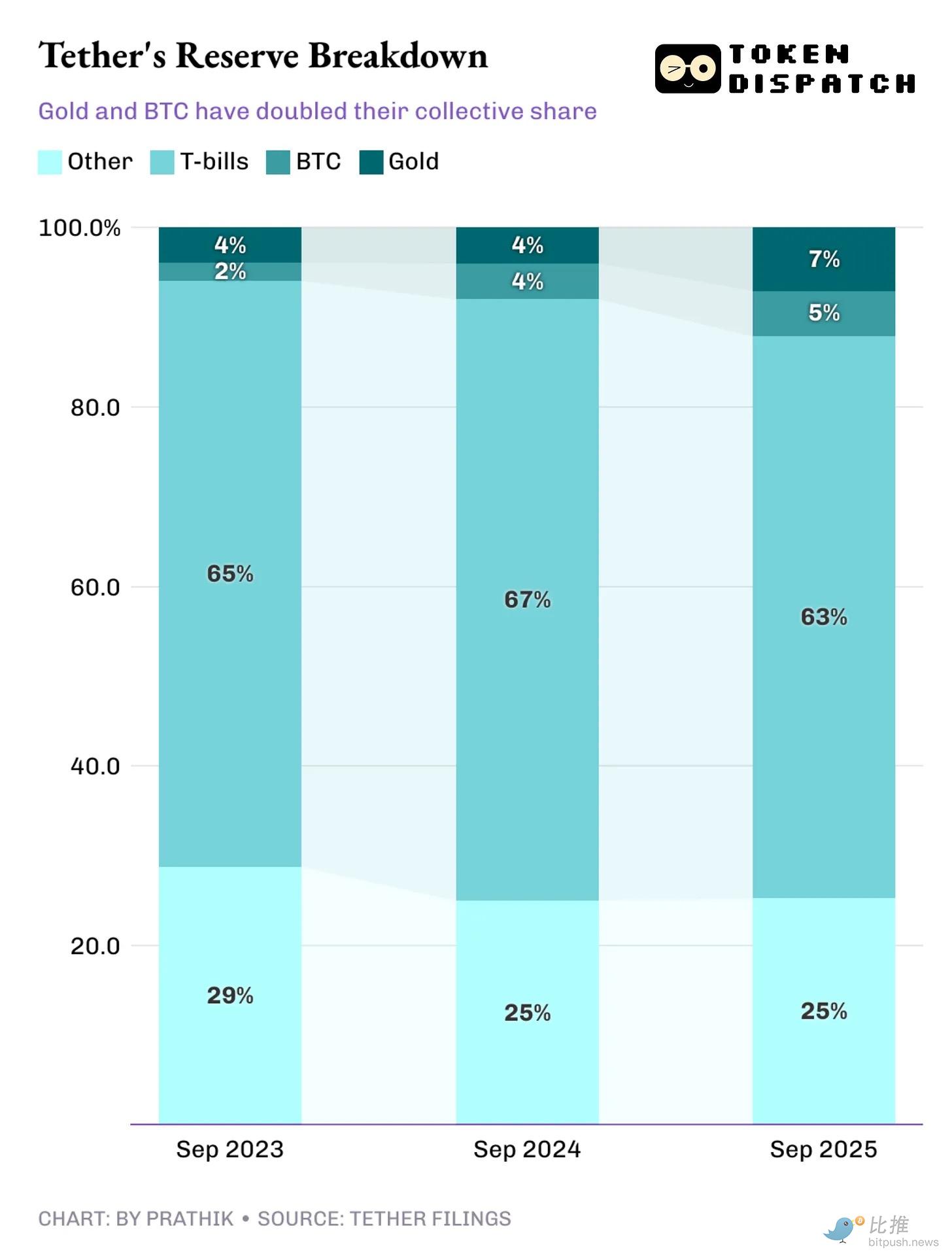

Between Q3 2023 and Q3 2025, the composition of Tether's reserve assets changed, incorporating asset classes rarely seen on the balance sheets of other stablecoin issuers.

As of September 2025, Tether had accumulated approximately over 100 tons of gold, valued at around $13 billion. It also held over 90,000 BTC, worth nearly $10 billion. Together, these account for about 12-13% of its reserves.

In contrast, its competitor Circle held only 74 Bitcoin, worth about $8 million.

Why the Shift Now?

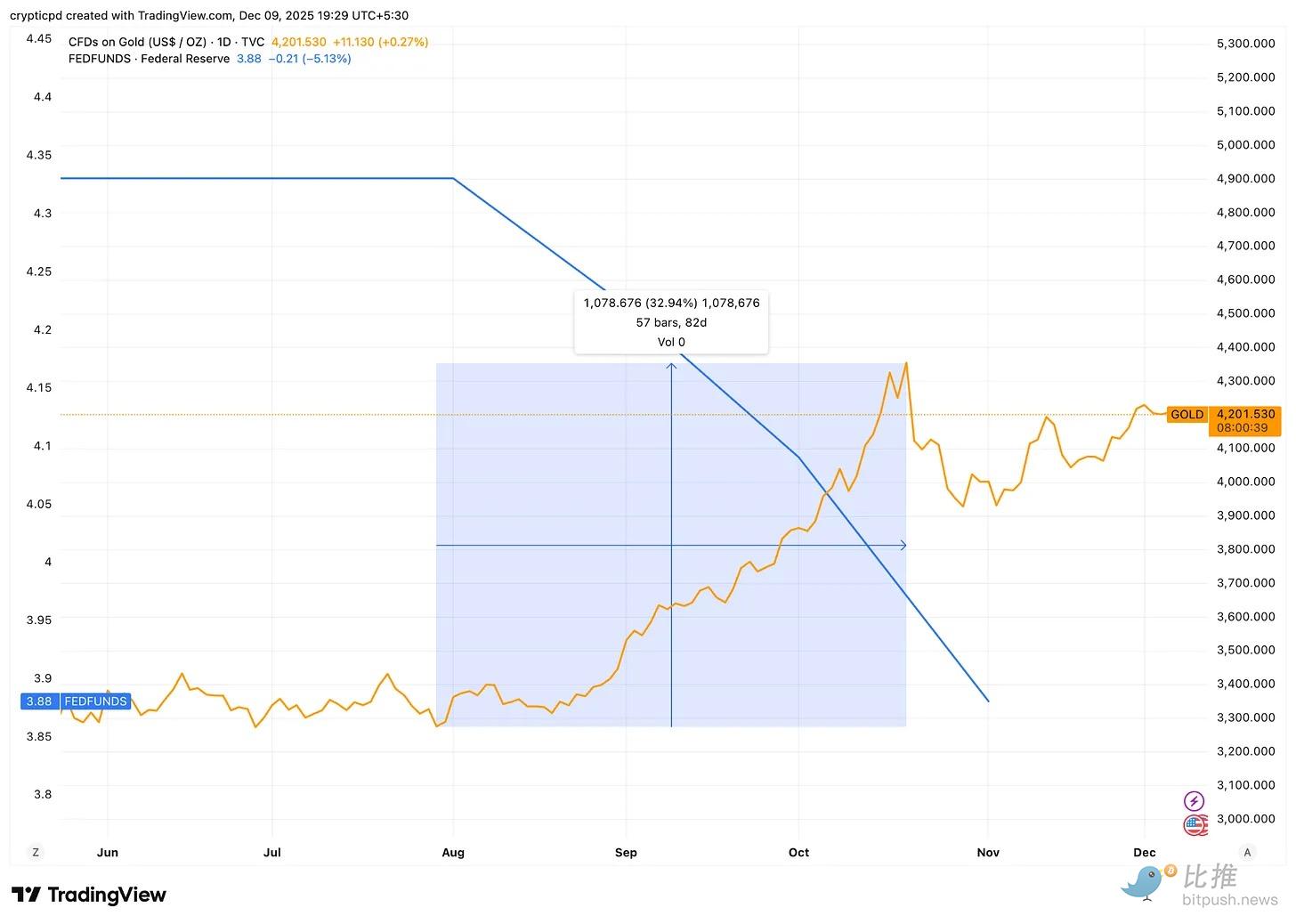

The increase in gold and Bitcoin allocations coincided with the period when the forward rate curve no longer predicted rate hikes.

In response to rising inflation, interest rates jumped from less than 1% to over 5% between May 2022 and August 2023. During this time, maximizing income by investing in US Treasuries made economic sense. But once interest rates peaked in 2023 and no further hikes were expected, Tether saw it as the right moment to start preparing for the turn in the interest rate cycle.

Why Choose Gold and Bitcoin When Yields Fall?

Gold tends to perform well when US Treasury yields fall. This is driven by expectations of rising inflation and the reduced opportunity cost of holding gold instead of low-yielding US Treasuries.

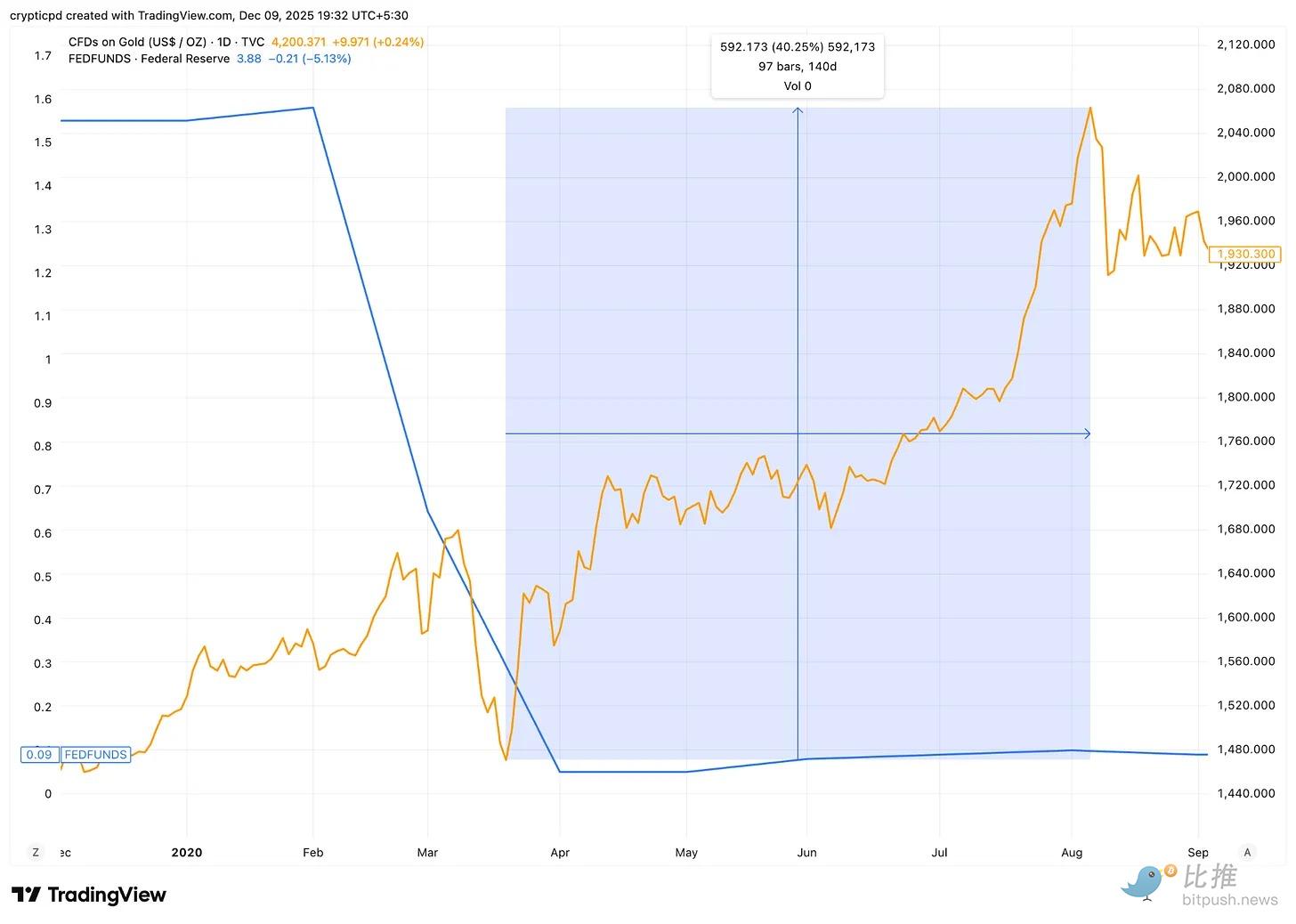

We saw this happen this year; when the Fed cut rates by 50 basis points, gold prices rose over 30% between August and November.

Even during the COVID-19 pandemic, when the Fed cut rates by 1.5 percentage points to inject liquidity into the economy, gold prices rose 40% in the subsequent five months.

Bitcoin has recently exhibited similar macro behavior. As monetary policy eases and liquidity expands, Bitcoin typically reacts like a high-beta asset.

Therefore, while a high-interest-rate environment allows for income through US Treasuries, allocating to Bitcoin and gold can provide potential upside in a low-interest-rate environment.

This allows Tether to book unrealized gains and even realize some profits by selling gold or Bitcoin from its vault, particularly during phases when interest rates are low and income is squeezed.

However, not everyone approves of the increased exposure to gold and Bitcoin on Tether's balance sheet.

The Peg Problem

Although US Treasuries still account for 63% of Tether's reserves, the increased exposure to riskier assets like Bitcoin and unsecured loans has raised concerns among rating agencies.

Two weeks ago, S&P Global Ratings reassessed Tether's ability to maintain the USDT peg to the US dollar from Tier 4 (Constrained) to Tier 5 (Weak). It noted the increased exposure to corporate bonds, precious metals, Bitcoin, and secured loans in its reserves.

The agency pointed out that these assets account for almost 24% of the total reserves. More troubling for the agency is that, although US Treasuries still back most of the reserves, the USDT issuer provides limited transparency and disclosure regarding the composition of these riskier asset classes.

Furthermore, there are concerns about undermining the peg of the USDT token to the US dollar.

S&P stated in its report: "Bitcoin now accounts for about 5.6% of USDT's circulation, exceeding the 3.9% over-collateralization margin, indicating that the reserves can no longer fully absorb the impact of its value decline. Therefore, a decline in Bitcoin's value combined with a decline in the value of other high-risk assets could reduce reserve coverage and lead to USDT being undercollateralized."

On one hand, Tether's shift in reserve strategy seems a reasonable measure to cope with the upcoming low-interest-rate environment. When rate cuts come—and they will—this $13 billion profit engine will struggle to sustain itself. The upside potential of the held gold and Bitcoin could help offset some of the income loss.

On the other hand, this shift has also rightly made rating agencies nervous. The primary task of a stablecoin issuer is to protect its peg to the underlying currency (in this case, the US dollar). Everything else, including the revenue it generates, its reserve diversification strategy, and the unrealized gains it can obtain, becomes secondary. If the peg fails, the business collapses.

When circulating tokens are backed by volatile assets, the risk profile of the peg changes. A sufficiently large impairment of Bitcoin—which we have been experiencing over the past two months—would not necessarily break the USDT peg but would narrow the buffer between the two.

Tether's story will unfold with the upcoming monetary policy easing. This week's rate cut decision will be the first indicator to measure this stablecoin giant's ability to defend its peg and signal its future trajectory.

Let's wait and see.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush